Charles Carroll Financial Partners

Mission Wealth has merged with Charles Carroll Financial Partners!

This strategic merger enhances Mission Wealth's ability to provide outstanding client service, aligning with the evolving needs of clients.

Mission Wealth Welcomes Bill Hayes and Andrew Conway

If you need to reach us, please use the updated contact information below.

Carroll W. “Bill” Hayes, MBA, CFP®

Partner and Senior Wealth Advisor

Phone: (855) 585-3600

bhayes@nullmissionwealth.com

G. Andrew Conway

Research Analyst

Phone: (508) 830-0600

aconway@nullmissionwealth.com

Mission Wealth Announces Merger with Charles Carroll Financial Partners

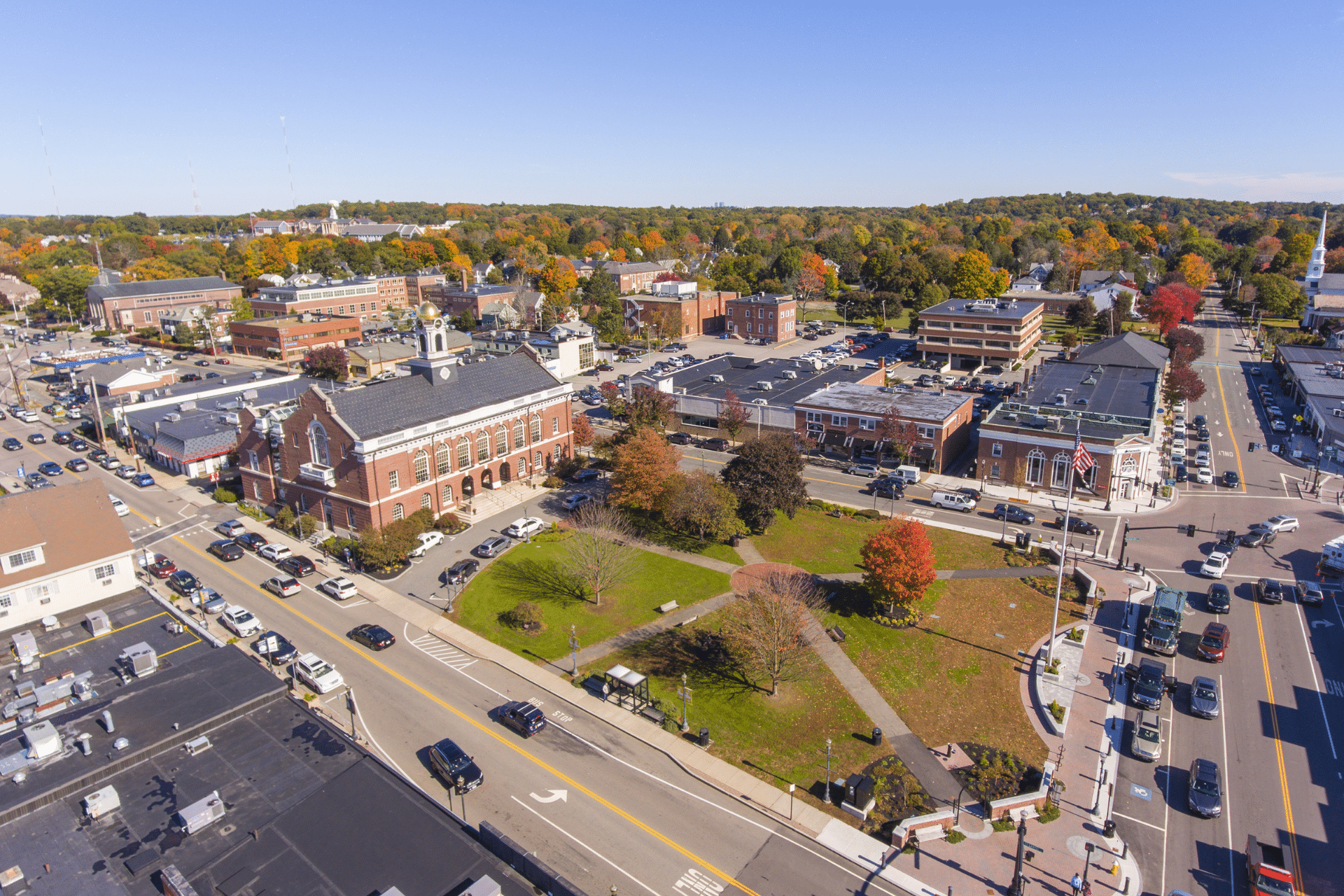

Needham, MA – March 1, 2024 – Mission Wealth LP has announced its merger with Charles Carroll Financial Partners, reinforcing the latter’s commitment to delivering exceptional client service and strengthening its internal succession plan. This merger represents the fourth integration in the past thirteen months for Mission Wealth and a union where Mission Wealth welcomes the firm’s 37th partner.